Puerto Rico Tax Break Beneficiary 'Evading' IRS Requests for Tax Information, Court Documents Say

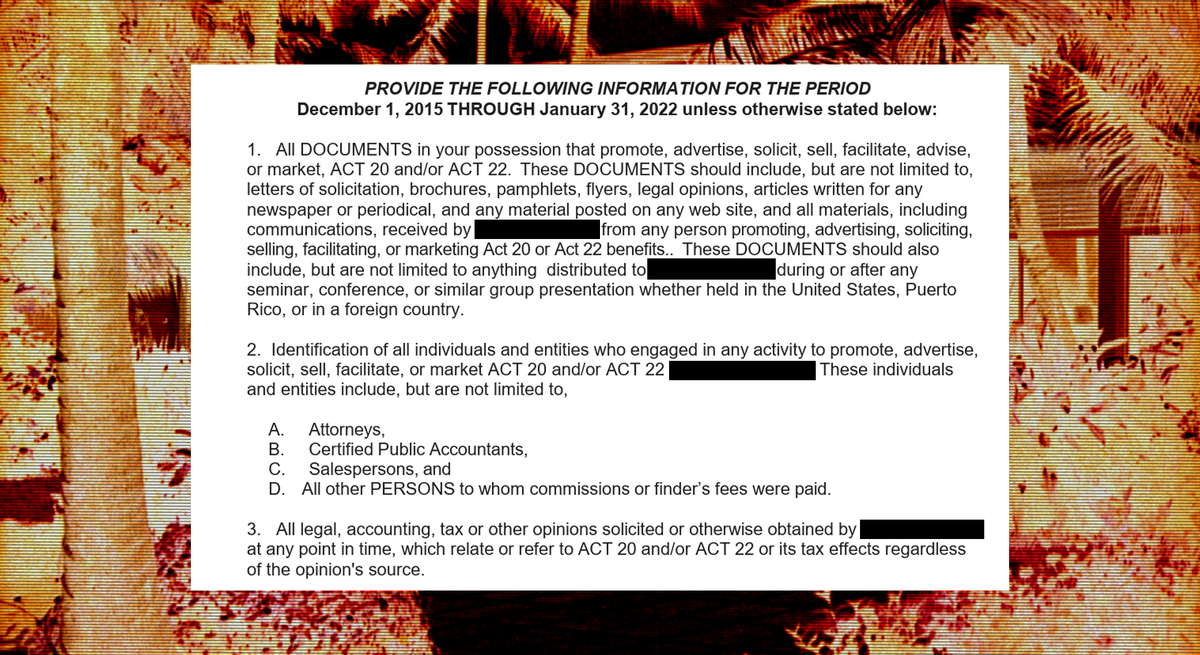

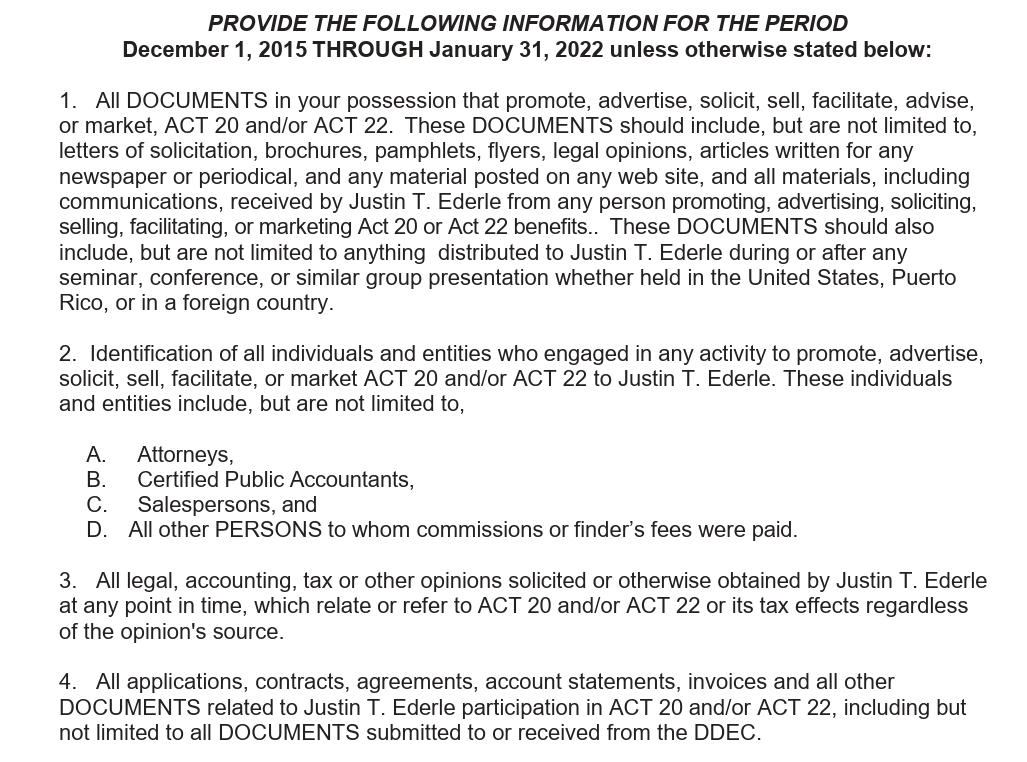

The summons issued to an Act 22 resident investor shows the type of information the Internal Revenue Service (IRS) asks for when they're investigating a tax decree holder's tax liability.

The Internal Revenue Service (IRS) requested a trove of financial and personal documents from Puerto Rico tax decree holder Justin Ederle to check if he owed them back taxes. However, he has reportedly been "evading" the IRS agent and U.S. Marshals trying to get him to hand over the information and failed to show up to court when ordered to, according to court documents obtained by Heavy Weather. The documents also show the type of information the IRS requests when they're investigating beneficiaries of Act 22, a controversial tax break meant to attract outside investors to the archipelago.

Late last year, the IRS sent Ederle a summons asking for documents from December 2015 to January 2022. The documents requested range from his and his businesses' tax documents to every plane ticket he purchased during the period. The federal tax agency also requested all documents that would identify anybody who promoted, sold, and marketed Act 22 and Act 20 – another tax break related to corporate tax rates – to him.

The agency requested the documents because they're trying to assess his tax liability for 2018 and 2019. However, they have not made any recommendation for criminal prosecution to the Department of Justice, according to a declaration signed by a Senior Revenue Agent filed in April. An IRS audit does not mean any fraud or misreporting has been committed, just that the agency wants to check for any possible discrepancies.

Ederle never gave the IRS the documents they asked for, the declaration alleges. So, the U.S. District Court issued an order in April for Ederle to appear in court and explain why he shouldn't be compelled to give them the information they requested. The court documents say an IRS agent and U.S. Marshals visited Ederle's last and usual place of residence several times to serve him the summons court order but were unsuccessful each time. A court eventually agreed to consider leaving the documents on his door as proof of service.